According to the Federal Emergency Management Agency, flooding is the most common and costly natural disaster in the USA.

The Department of Financial Regulation has no jurisdiction over flood insurance carriers; however, it does regulate insurance agents and provides useful educational materials and resources to facilitate understanding of what flood insurance is, determining whether to purchase it, and navigating the claims process through the National Flood Insurance Program.

Why Buy Flood Insurance

Whether a property owner, renter or business/organization, no one is completely safe from potential flooding. Did you know that an inch of water in a home can cause more than $25,000 in damage? Having flood insurance can mean the difference between recovery and financial devastation. Unfortunately, most homeowners and renters insurance policies do not include coverage for flood damage.

Download this brochure: "Why Do I Need Flood Insurance?" FEMA provides this brochure to help consumers understand why flood insurance is important and to provide references for commonly asked questions.

Test Your Knowledge About Flood Insurance

The National Association of Insurance Commissioners asks you to test your knowledge of flood insurance: take the interactive NAIC Flood Quiz to find out how much you know – or don’t know – about flood insurance.

National Flood Insurance Program

Because policies vary, the Department urges you to consult your agent and review your policy to determine the types of flood perils covered by your insurance. Flood damage or damage caused by rising ground water typically will only be covered if you purchased flood insurance through the National Flood Insurance Program. The NIFP provides flood insurance to property owners, renters and businesses in communities that choose to participate. FEMA just released its 2024 FEMA Policyholder Claims Handbook.

About 90 percent of Vermont communities participate in the National Flood Insurance Program. Use the FEMA FloodSmart online search tool to find participating insurance carriers and agents in your area. FEMA manages the NFIP, which provides flood insurance through a network of more than 50 insurance companies and the NFIP Direct.

Three Components of the NFIP

Origins of the NFIP

The NFIP was established by Congress through passage of the National Flood Insurance Act of 1968. The NFIP is administered by the Federal Emergency Management Agency (FEMA) and community participation in the program is voluntary.

Vermont Flood Resources

Numerous flood resources including maps, prevention ideas, training and more are available at Vermont Emergency Management and Flood Ready Vermont. Get help filing a claim through the NFIP and learn about community funding available for mitigating flood disasters through the Flood Resilient Communities Fund.

About the Flood Resilient Communities Fund | "The FRCF was established by the Vermont Legislature under Act 74 with the intent of improving landscape and community resilience and reducing the future public safety and water quality impacts of climate-related flood hazards in Vermont, focusing on buyouts of flood-vulnerable properties. This is a voluntary program that will prioritize projects in communities and/or for homeowners with greatest economic need and projects that mitigate repetitive loss among low-income and marginalized portions of the population."

How to Obtain Flood Insurance

Contact your insurance company or agent to purchase flood insurance. Need help finding a participating insurance company or agent in your area? Visit FEMA FloodSmart to search for a participating carrier and agent in your area. Or call the NFIP at (877) 336-2627.

NFIPDirect - Use FEMA NFIPDirect online portal to access your flood insurance.

How to File a Flood Claim

To start a flood claim, always contact your insurance carrier, agent or contact the NFIP at (877) 336-2627.

Understanding the claims process is important. The FEMA NFIP offers guidelines and steps to follow while starting your flood insurance claim and work with your adjuster and agent. The more you know, the smoother the process will go. The NFIP also provides underwriting, adjusters and policy holder claim forms.

How to Appeal or Update Your Flood Claim

Once your claim has been filed, you have options. If unsatisfied with the claim amount paid or to make adjustments to it, visit FEMA to file an appeal and/or to make changes to your claim.

Additional Resources

FEMA

- All About Flood Insurance – NAIC

- FEMA FloodSmart.gov

- FEMA FloodSmart – Why Buy Flood Insurance

- Flood Costs – FEMA FloodSmart.gov tool for finding out how much a flood disaster can cost.

- Flood Insurance Library - The NFIP maintains numerous publications, videos, graphics and online tools “that assist policyholders, agents and other servicers in navigating the flood insurance process before, during and after disaster. Digital resources can be downloaded, and certain print publications can be ordered for free.”

- Know Your Flood Risk: Homeowners, Renters or Business Owners

- National Flood Insurance Program Fact Sheet

NAIC

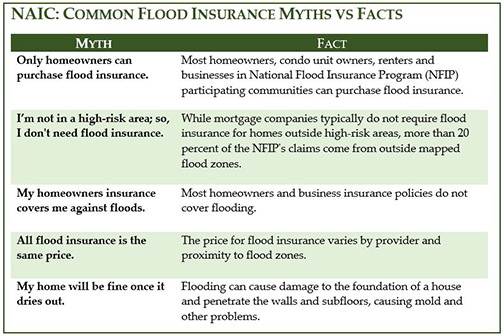

NAIC Flood Insurance - FAQs, Tools, Myth vs Realities and more.

For Agents

- Risking Rate 2.0: Equity in Action - NFIP has changed the way it determines flood risk and prices flood insurance.

- Adjusters Claim Forms - FEMA