Why You Need to Know

Wondering what the No Surprises Act means to you as a patient? As a healthcare provider? Health insurer? Hospital or medical service corporation administrator? HMO executive?

While the law lays the bulk of the responsibility for protection on providers and insurers, it is just as important for the public to know how the law benefits them and how to seek assistance if or when they suspect non-compliance with it. And because consumer and provider education are important to guaranteeing effective protections, this Department web page provides resources useful for understanding the law, ensuring compliance and resolving disputes.

What Is the No Suprises Act?

A measure included in the Consolidated Appropriations Act of 2021 – an omnibus bill that also provided funding for the federal government and COVID-19 pandemic stimulus relief – the No Surprises Act protects consumers with most types of private health insurance coverage against certain surprise medical bills.

On December 27, 2020, the CAA was signed into law. On January 1, 2022, the NSA went into effect, and, later the same year, the Vermont legislature approved a Collaborative Enforcement Agreement with the Federal Government.

Coverage types included: fully insured plans, Qualified Health Plans and self-insured plans (including plans governed by the Employee Retirement Income Security Act of 1974 - ERISA).

What the NSA Means to You

Surprise Medical Billing

Many people have experienced receiving surprise medical bills, also known as “balance bills". When patients unknowingly receive care from providers outside their health plan, the out-of-network provider often bill them for up to the full charge for the service. A common example: a patient goes to an in-network hospital for a surgery but then is billed by an out-of-network anesthesiologist on the surgical team. Note: with some case exceptions, both Medicare and Medicaid prohibit providers from balance billing recipients.

Coverage

The Vermont Essential Health Benefits Benchmark include items and services in the following ten benefit categories: (1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and newborn care; (5) mental health and substance use disorder services including behavioral health treatment; (6) prescription drugs; (7) rehabilitative and habilitative services and devices; (8) laboratory services; (9) preventive and wellness services and chronic disease management; and (10) pediatric services, including oral and vision care. All these items are covered by the NSA.

Independent Dispute Resolution (IDR)

Billing disputes often can be settled through initial contacts. Now, when agreement between providers and/or providers and consumer fails, the NSA has a defined IDR process that can be triggered by either party after the 30-day negotiation period. The IDR process is meant to drive down health-care costs, help both parties negotiate a payment rate, and reduce the harms of surprise bills.

The NSA-Defined Process for Determining Out-Of-Network Reimbursement

- First - the provider may accept the health plan’s initial reimbursement offer;

- Second - the provider and health plan may negotiate a mutually acceptable rate during a 30-day period beginning the day the provider receives initial payment or payment denial from the health plan;

- Third - the provider and health plan may bring a reimbursement dispute to a new independent dispute resolution (IDR) process under the NSA.

Like many states, Vermont uses the federal system for resolution of out-of-network payment disputes. Use the Department of Health & Human Services IDR Initiation to start the process or email FederalIDRQuestions@cms.hhs.gov with questions.

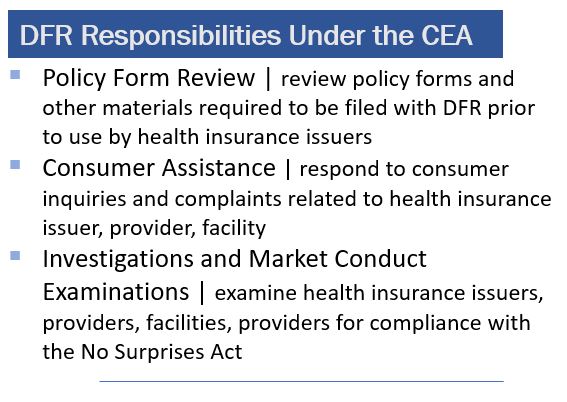

NSA Enforcement | Collaborative Enforcement Agreements

To enforce protections under the No Surprises Act, most states are partnering with the federal government. Under the NSA, states have a primary role in enforcement, even for patients covered by federally regulated health plans; to assist states, the federal government offered states an opportunity to enter into a Collaborative Enforcement Agreement. Last year, Vermont enacted Act 137 of 2022; Section 1, directs the Commissioner of Financial Regulation to “enforce the requirements of the No Surprises Act as they apply to health insurers, hospital and medical service corporations, health maintenance organizations, and health care providers[.]” The Vermont CEA covers all provisions of the NSA, except those relating to air ambulance providers. Under these agreements, states conduct policy reform review; investigations; market conduct examinations; consumer assistance. The Commissioner may also refer cases of noncompliance to the U.S. Department of Health and Human Services under the terms of a collaborative enforcement agreement, or to the Office of the Vermont Attorney General.

Questions? Email DFR Asst. General Counsel Sebastian Arduengo or call him at 802/828-4846.

Additional Resources

• CMS Frequently Asked Questions for Providers

• CMS No Surprises Act Website

• Coverage - Marketplace Plans

• Details on Enforcement by States

• IDR Initiation Portal

• Information on Essential Health Benefits (EHB) Benchmark Plans

• Vermont Essential Health Benefits Benchmark Plan

No Surprises Help Desk: 1-800-985-3059 from 8 am to 8 pm EST, 7 days a week.

Other forms and materials available online at the CMS website.