The Department of Financial Regulation

Flood Recovery Resources: State • DFR

What is financial regulation? Succinctly, it is the regulation and supervision of financial markets and institutions.

With a strong leadership team, its reputation for regulatory excellence and international recognition for the strength of its insurance and captive insurance divisions, the Vermont Department of Financial Regulation plays a key role in ensuring market efficiency and integrity, consumer and investor protections, capital formation or access to credit, as well as illicit activity prevention, financial stability and consumer financial education.

Globally recognized as a leader in the captive insurance arena, the Department consists of four divisions — Banking, Captive Insurance, Insurance, Securities — and an administrative office that includes the Commissioner Office and legal staff.

The Department Mission

To promote and assure the financial health, stability, quality and integrity of Vermont financial service providers. The Department also strives to secure full access for Vermonters to financial services and to protect the public through the consistent enforcement of the laws and regulations necessary to the operation of a safe, sound and responsible marketplace and through consumer outreach and education.

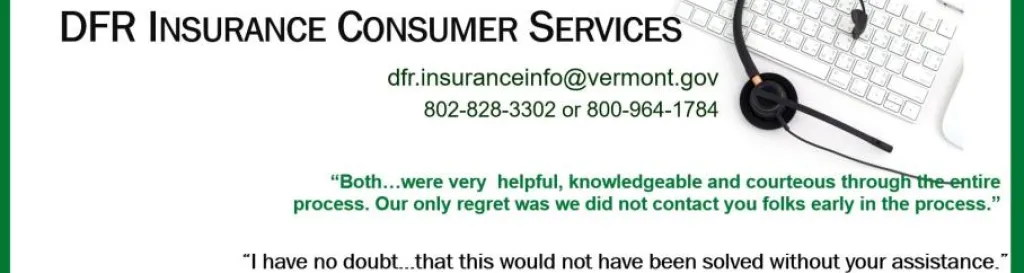

Consumer Resources

File a Complaint: Verify a License:

- Bank, Credit Union, Mortgage Lender, Etc. Financial, insurance or security agent/producer or company.

- Insurance - Auto, Homeowners, Life, Medical, Etc.

- Insurance - Healthcare Claim Denial Appeal

- Securities - Investments, Sales, Brokerages

Quick Links:

Securities Restitution Fund • Financial Education, Tips, Guides • Insurance Information by Types • Avoid Scams/Fraud